It's been a while since I really looked at my expenses, so I sat down today and opened up my expense report. It was surprising, and also kind of interesting, so I figured I'd share it.

Note: The above graph got just a little cut off. Click here for the full version.

The Numbers

First, some interesting figures:

- My current total yearly spend is something like $51,000.

- Without taxes (which are included in the total above), my total yearly spend is something like $25,000, (yes, over 50% of my expenditures go to taxes).

- It's hard to tell what my actual non-essential personal expenses are from this because I track that in my budget categories (which are currently unreportable because of a frustring nuance of GnuCash). That said, my allotted personal expenses budget is about $200 per month, and I'm currently overspent on that by about $40, which indicates that that's probably right around what I spend on myself every month.

The Details

What jumped out at me right away was that over half of my spent cash goes to taxes! This is not because I'm making millions of dollars and am in a high tax bracket; it's because I don't spend all that much money outside of essentials. Thus, I pay taxes, then pay rent, then buy food, and then don't really do all that much else.

The next biggest expense was, predictably, housing. This is actually going up, since I raised my rent to $500 per month a few months ago (still probably half of what I'd be paying if I lived alone, so I'm still totally thrilled with my arrangement with Reed, who is also a very good roommate). The housing top-level category also includes utilities, but frankly, that's not much for me. Reed and I switched to 100% renewable electricity earlier this year and it's still only costing us $40 per month between the two of us. The benefits of having a small apartment and an eco-friendly roommate (and heating and cooling costs externalized as assessments, rather than direct charges).

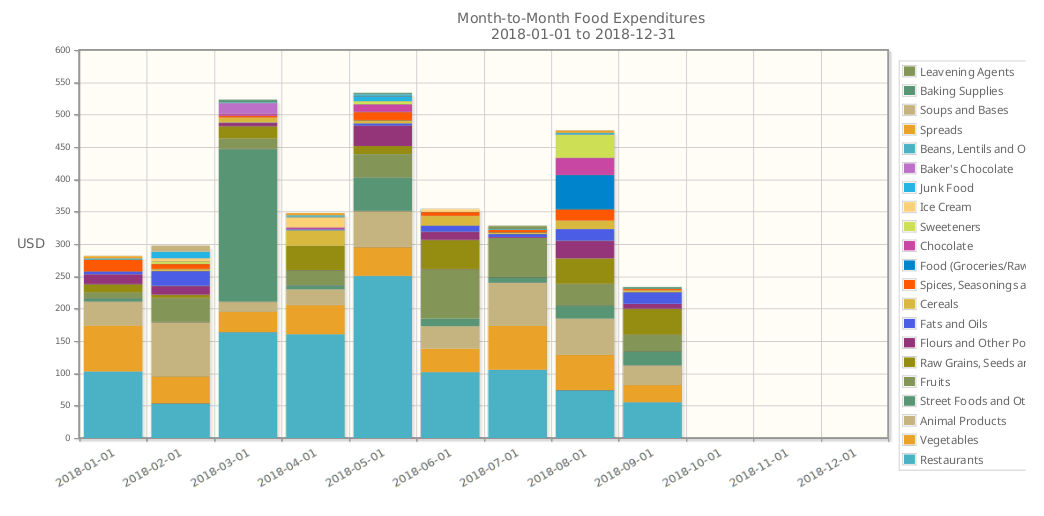

After that, food.... This one really was surprising, because I've never spent more than $200 per month on groceries, and that was back at the peak of cherry season. I dug in a little bit and discovered that back in March (my Mexico trip) I had registered almost $250 in street food expenses alone (which I think was more just lazy accounting during the trip) and in May (Mothers Day) I had registered another $250 in restaurants. August was also a little bit of an exception, as it was the first full month post-breakup, which means I had to buy all the basic groceries I hadn't bought for months because I had been cooking at Amy's so much prior. Still, $463 per month on average for food seems preposterous, and I'll be tracking that more closely now.

Here's a breakdown, in case you're interested:

The last few major categories were insurance, health care, giving, and transportation, and each has a small detail that stands to be explained:

- Insurance: I'm counting in this my employer's contribution to my insurance, so while I don't actually pay $240 per month for it in cash (my portion is something like $110), $240 represents the actual expense.

- Health Care: While my normal health care expenses are very low, since the breakup, I've continued to see the therapist that Amy and I were seeing during the last months of our relationship, and that has represented a massive increase in health care expenses ($150 per week over the last month and a half, though I'm winding it down now.) This has been great, though, and I still have plans to write about my conceptions of having a "Primary Care Therapist", which I think is a flagrant ommission in our modern health care landscape.

- Giving: This one isn't actually very useful or accurate. It includes only things like donations and cash for homeless people or street musicians, while things I purchase for friends and family (like dinner or Christmas gifts) are usually slotted into their respective item categories. The real figure for what I give every month is tracked in my budget categories, which, due to the annoying limitations in GnuCash I referenced above, are unreportable for now. (I've got aspirations to start work on a new budgeting software soon that will allow me to report on these numbers, but that's a ways off still.)

- Transportation: Over 50% of my transportation expenses are actually the airfare for my trip to Mexico in March, and another 33% are "Bus and Train", which also includes buses in Mexico. This is another weird little misrepresentation that I think will be solved with my better budget reporting software when eventually it comes into existence.

All for now, and as always, if you're interested in digging deeper into my finances, feel free to download my current GnuCash file and look at it yourself.